OUR BLOG

NEW 2024 REPORTING REQUIREMENT

Beneficial Ownership Information (BOI) Reporting is a new reporting requirement in effect in 2024 for all reporting companies

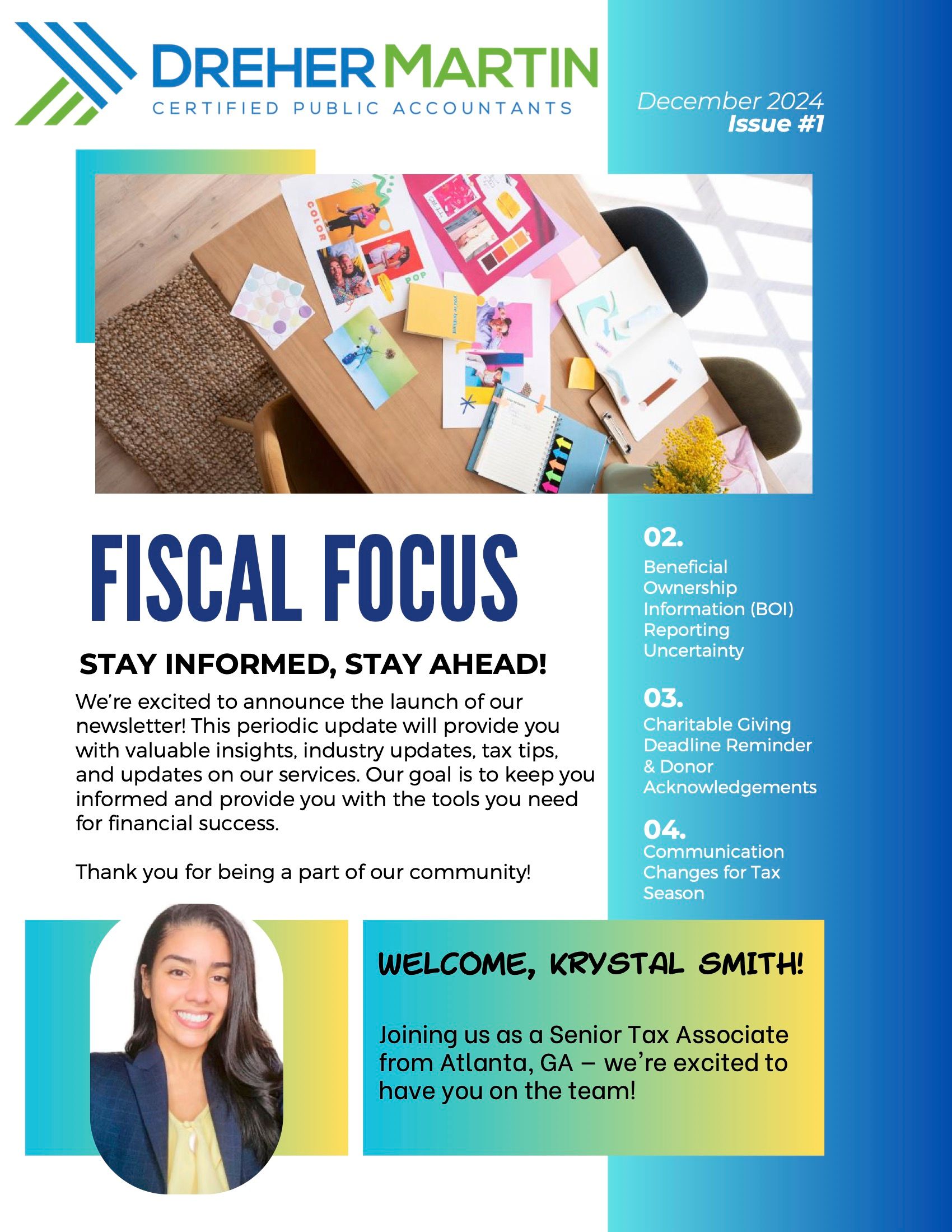

December 2024 Newsletter Issue #1

Click below to download the December Newsletter as a PDF...

Read more

New 2024 Reporting Requirement

The post New 2024 Reporting Requirement appeared first on...

Read more

Business Meals

Business Meals: 2023 Update During 2021 and 2022, we encouraged business owners to take advantage of business meals as they were 100% deductible. In 2023,...

Read more

Inflation Reduction Act of 2022

The Inflation Reduction Act of 2022 (IRA) passed in both the Senate (August 7, 2022) and the House (August 12, 2022). IRA is a much scaled-back version of President Biden’s Build Back Better Plan...

Read more

Single Member LLCs and the Pass-Through Entity Tax Election

This article is a follow-up to our article regarding the Pass-Through Entity Election located here /2022/06/north...

Read more

North Carolinas New Pass-Through Entity Tax Election

On November 18, 2021 North Carolina governor Signed Senate bill 105 which includes a new elective Pass–Through Entity Tax (“PTET”). This law, first effective in 2022, has the potential to save...

Read more

Will the State and Local Tax (SALT) Deduction Cap be repealed?

In 2017, the Tax Cuts and Jobs Act went into effect, limiting the SALT deduction to $10,000 and doubled the standard deduction amount. This action was thought to be punitive to high tax...

Read more

New Lease Standard – Now is the Time to Prepare!

On February 25, 2016, the Financial Accounting Standards Board (FASB) issued Accounting Standards Update (ASU) 2016-02, Leases (Topic 842). The new lease standard will take effect for fiscal years...

Read more

The New 1099-NEC and 1099-MISC: What Every Organization Needs to Know

In the continually changing landscape of 2020, we can add a new form for 1099 Reporting. All payments for Contract Labor previously reported in Box 7 of the 1099-MISC will now be reported on the...

Read more

Beer and Taxes: An Industry Perspective

When I think of my favorite brewery, it is an image of laughter with friends, a relaxed atmosphere, and a great IPA. Unfortunately, the picture gets destroyed when I look at the Alcohol and Tobacco...

Read more

Audits Ahead! Prepare Now for your Calendar Year 2020 Audits

If 2020 hasn’t been challenging enough, the cherry on top of this year – your annual audit! Since 2020 has been like no other, why should your audit be...

Read more

Tax Planning: What should business owners be thinking about right now?

As we head into the end of the year, specific questions need to be asked to ensure that you are prepared for 2020 taxes. For business owners, now is the...

Read more

Change Management Experts

After 2020, no one gets to claim that they cannot change. Being forced to change is a very revealing process that allows you to see how scrappy you are....

Read more

Loan or Income: How should my PPP loan be classified?

For your business, is the PPP program a loan or income? As 2020 is coming to a close, organizations are starting the PPP loan forgiveness process. You can check all the boxes that indicate you have...

Read more

View more